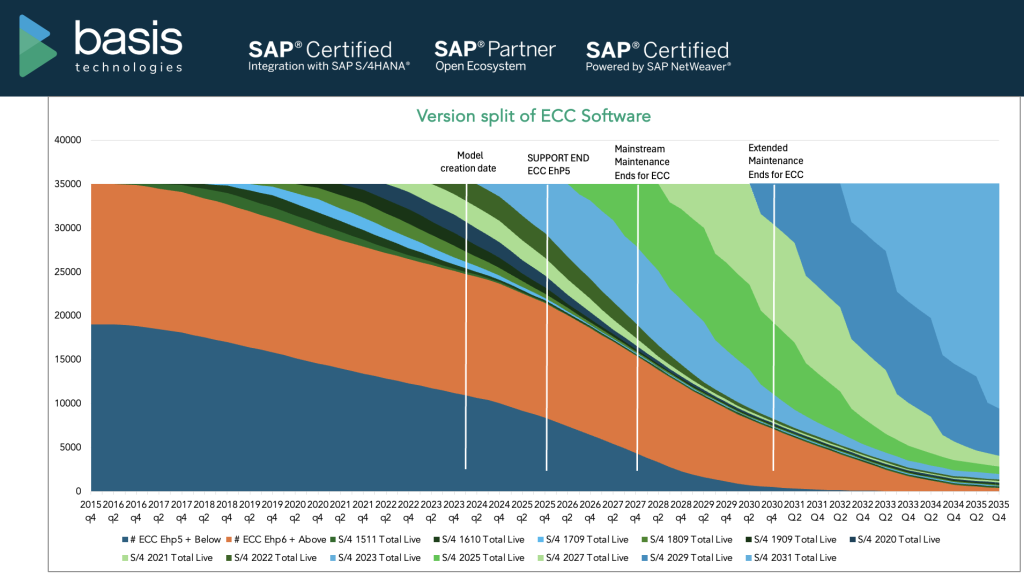

Only 57% of ECC customers will have completed their transformations to S/4HANA when mainstream maintenance finishes at the end of 2027.

Like many organizations and individuals in the SAP space, I’ve attempted to estimate S/4HANA adoption several times over the past few years. This year, I’ve taken this a step further with an open, customizable SAP Adoption Model backed by data from SAP, Gartner, and Basis Technologies and extensively peer reviewed by leading SAP experts. This article is a breakdown of its findings.

S/4HANA by the numbers in 2024 (so far)

Based on historic SAP and Gartner data, of the original 35,000 ECC customers, less than a third (28%) or so were live at the end of 2023. There is an industry expectation that adoption rates will increase, and that SAP will make progress on supporting smaller customers with their migrations to RISE and GROW.

However, despite this predicted acceleration, the model reveals that only just over half (57%) of ECC customers will have finished their transformations to S/4HANA when mainstream maintenance finishes at the end of 2027. By the end of 2030, this could have reached 80%, but would take until the mid 2030s for all customers to complete the journey.

Along the way, customers who have already completed the transformation also run the risk of running out of maintenance on initial S/4 support packages, and those customers still running ECC enhancement Pack 5 or below have an even shorter runway until end of 2025 – without the option for extended maintenance.

At the end of 2025, a third (33%) of all ECC and S/4HANA customers could be out of mainstream maintenance. By 2027, this is projected to increase to 55%.

The model includes assumptions for customers who will upgrade their ECC version in order to access five years more runway (two additional years of mainstream maintenance in addition to three years of optional extended maintenance).

There are a significant number of projects already in-flight, and the amount of resource forecasted to be consumed by the S/4HANA transformations, the ECC upgrades and the likely S/4-to-S/4 upgrades is high. In fact, resource peak could be another three to four years away, with more than 75% additional resources involved compared with today.

A warning for early adopters and compatibility packs

It’s also important to understand that even for customers who have already migrated to S/4HANA, there are pressing deadlines to prepare for. All customers who went live on versions of S/4 released prior to 2020 will be unsupported from the end of 2025, requiring an additional, although much more manageable, upgrade effort.

Early adopters of S/4HANA who rely on Compatibility Packs to plug functional gaps in their version of S/4HANA also face an expiration date before the end of 2025, requiring an additional transformation (and most likely an S/4 upgrade).

End of ECC support by 2027

While SAP has announced it will stop supporting ECC officially at the end of 2027, it will be possible to buy extended support for a higher premium through to 2030 on a case-by-case basis. This date has been pushed back before and it’s possible it will be delayed again considering the backlog of transformation highlighted above. When SAP finally ends support, companies will either have to use third-party maintenance services or switch to another ERP platform if they haven’t already made the shift.

Regardless of when SAP does finally end support for ECC, that only applies to the ECC application itself, not the database it runs on. Even assuming SAP does delay the end-of-life date for ECC, companies might still have to migrate to Suite on HANA.

Many SAP users currently run their ECC landscape on a non-SAP database like Oracle or IBM’s DB2. This is worth checking with the respective DB vendors and could be influenced by the channel the DB licenses were acquired via (direct or through SAP).

That means even if you choose to “play chicken” and just wait to see what SAP is going to do regarding ECC support, you could be required to consider a DB upgrade or even in worst case a migration to Suite on HANA (ECC running on HANA).

The state of play

This leaves SAP and their ECC customers in a challenging position. S/4HANA migration projects already promise to be extremely time-consuming and complex but every delay in beginning the project could lead to more complexities, which means more time and costs. It’s not unforeseeable for companies to find themselves in a situation where they simply won’t be able to begin their migration project when they want to. Resources will become a key constraint and automation will be a necessity.

My assumption is that SAP will be forced to push their end-of-life dates back again, but I wouldn’t expect that to happen immediately. Most likely they will wait as long as possible to push it back in order to put pressure on as many customers as possible to begin their upgrades.

Conclusion

If organizations wait much longer to get started, it will become immensely more challenging to secure the resources they require to facilitate a successful transformation. This is shaping up to become a smaller scale Y2K event.

If you’re running on ECC EhP 5 or below, consider an ECC upgrade to give additional “runway” beyond 2025. As well as this, make sure to identify opportunities to automate key activities and get the right partners and tooling in place to ensure success. Contact us if you need support with automation.

Finally, be prepared for further S/4HANA upgrades once running on it, and consider options to make your ERP “core” more agile and easier to upgrade.

About the Adoption Model

The statistics and graphs explored throughout this article were generated by my open, free-to-use Adoption Model that helps you analyze the current migration progress and support package landscape. It’s backed by the latest insights from SAP, Gartner, and Basis Technologies, and cross-referenced against deadlines, resources, and package support.

The Model has been peer reviewed by SAP experts and commentators, Josh Greenbaum and Jon Reed, as well as Pierre-Francis Grillet, Global Lead of SAP Services at SoftwareOne, Robert Holland, SAPInsider’s Vice President and Research Director, and Stuart Browne, Founder of SAP consulting firm Resulting IT.

If you’d like your own copy of the model to create custom reports with alternative variables, you can download it here.